There are few investments that can be as impactful to a community as an investment in a historic rehabilitation project. In many cases, these projects are located in older, often neglected areas, lacking capital investment, economic opportunities and property tax revenues. An investment in a historic tax equity fund can change all of this while preserving important aspects of American history.

Monarch’s historic tax equity funds invest in projects which transform buildings with noteworthy history that have fallen into disuse or disrepair. They preserve both the history and valuable resources of the community while also sparking social, economic and environmental growth.

Historic rehabilitation projects often serve to revitalize entire neighborhoods by encouraging entrepreneurs to develop restaurants, retail, commercial and affordable living spaces, resulting in higher property and sales tax revenues for local governments. In turn, this allows governments to improve schools and services within these neighborhoods.

Make an impact by redirecting your tax dollars to unlock the value of historically significant buildings and secure their potential for a more prosperous and sustainable future.

The rehabilitation of historic buildings can bring a number of significant advancements to communities, both social and economic. By creating jobs and developing new housing opportunities, the federal HTC program can revive blighted neighborhoods and bring positive change to those who live there.

Rick Chukas, Partner & Managing Director of Historic Tax Credits

Making a Difference

Restoring a historic property appeals to visitors and the local community alike. Not only is it preserving a piece of history but reuse of a property is more beneficial for the environment than demolition. Our mission is to create new futures for historically significant buildings by investing in and attracting investors to successful historic rehabilitation developments. From Fortune 500 companies, to banking and insurance investors, our historic tax credit funds address a variety of needs present in many communities.

Since the launch of our Historic Rehabilitation division in 2012, Monarch has facilitated investments in federal historic tax equity in projects generating:

$3 billion

total in rehabilitation investment

$2 billion

in income

$3 billion

in GDP

$6 billion

in output

$850 million

in taxes

50,000

new jobs

180

Historic Rehabilitation Projects

Impact Calculator

Want to see the impact of your socially responsible investment? Select an investment type and enter your dollar amount and we’ll quantify it for you.

Our Approach

Our Historic Rehabilitation division provides federal and state tax credit equity and bridge loans to development teams that focus on historic rehabilitation projects.

- We provide capital at the beginning and throughout the construction process including bridge lending, if necessary.

- We operate through a variety of different funds created for our various investors in which we serve as Managing Member.

- We have full discretionary rights and responsibilities as fund manager including executing all project level documents and committing all contributions required under the terms of the operating agreement at the project level. Many of our fund investors require anonymity so as not to have to deal with project level requests, issues or direct solicitations by brokers.

- When we commit to a project we fully stand behind and support that obligation. Unlike others in the marketplace, we do not simply serve as brokers on transactions wherein the ultimate investor is responsible for due diligence and execution of documents at the project level.

Background

About the Federal Historic Tax Credit (HTC)

Since 1977, the HTC has played an imperative role in revitalizing communities and sparking economic growth across the country. The HTC is the most significant investment that the federal government makes toward the preservation of historic buildings. The program targets properties listed on the National Register of Historic Places and transforms them into vibrant, contributing members of their communities. The National Park Service and the Internal Revenue Service administer the program in partnership with State Historic Preservation Offices.

- The HTC is a form of additional project capital.

- The Federal HTC is equal to 20% of qualified rehabilitation expenditures.

- The Federal HTC is currently available as a five-year credit.

- The Federal HTC can generally offset up to 75% of current year tax liability. Excess credits can be carried back one year and carried forward for 20 years.

- Tax savings result in a lower effective tax rate and permanent GAAP earnings.

- Recapture, or partial recapture, is triggered if a project ceases operations, or if there is a change of ownership, within a five-year window after being placed-in-service. Insurance can be acquired to cover recapture risk.

- All investments are structured to be PAM-compliant.

- Low Risk: The annual recapture rate of historic tax credits based on a study conducted in 2012 is estimated to be 0.073%.

About State Historic Tax Credits

To spur more private investment in older neighborhoods, more than 30 states have had tax credit programs that offset a variety of state taxes, which in some cases, also include premium taxes. Most of the state programs are based on the federal HTC program, although application processes, award amounts, and award procedures vary by state.

State credits can be used in combination with the federal credits for income-producing properties. While Monarch focuses on income-producing historic rehabilitations, many state programs also offer historic tax credits for rehabilitation of owner-occupied residential properties.

Benefits

Through the federal HTC program, you can help redevelop blighted buildings that can lead to the revitalization of an entire community. When historic buildings or industrial mills are redeveloped, they take on a new life and generate economic activity from professional offices and retail space to restaurants and manufacturing.

Over the life of the program, the HTC in the U.S. has:

- created more than 2.5 million good-paying local jobs,

- leveraged $144.6 billion in private investment in our communities,

- generated more than $32.4 billion in federal tax revenue and preserved more than 44,341 buildings that form the historic fabric of our nation.

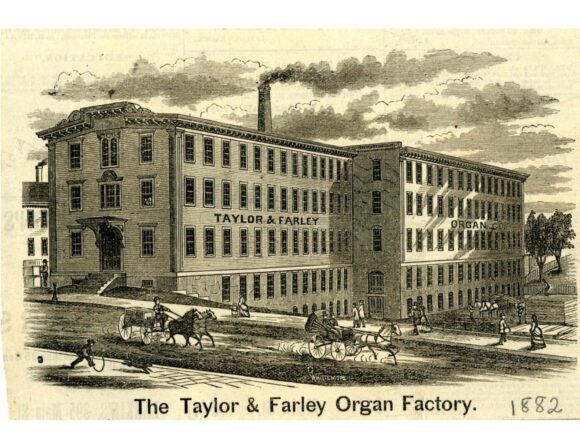

Featured Projects National Women’s Hall of Fame

The National Women’s Hall of Fame, one of the first national organizations dedicated to recognizing and celebrating the achievements of great American women, was founded in 1969 in historic Seneca […]

View Project

Featured Projects Hotel Clermont

For nearly a century, the award-winning Hotel Clermont has held its status as one of Atlanta’s most prominent and beloved landmarks. Its notoriety and alluring mix of everyday amenities and […]

View Project

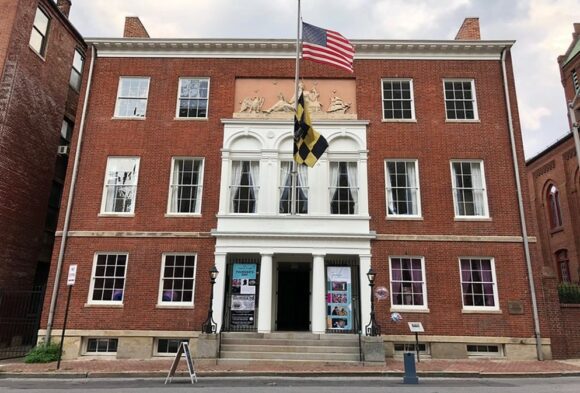

Featured Projects The Peale

Located in Baltimore, Maryland, The Peale is an innovative, award-winning museum that amplifies and presents the voices and stories of Baltimore’s diverse communities, helping preserve the whole story of the […]

View Project