Monarch Private Capital Launches New Website

Educates visitors on combining tax credit equity and ESG investing

Monarch Private Capital, a nationally recognized tax-advantaged investment firm that develops, finances, and manages a diversified portfolio of projects that generate both federal and state tax credits, is pleased to announce the launch of its new Tax Credit Equity + ESG website.

Many investors are becoming increasingly aware of the importance of integrating environmental, social and governance (ESG) criteria into their investment process. However, most are not aware that they can redirect their tax dollars to help them achieve their ESG goals. Monarch recognized this lack of knowledge and launched a new website to help educate investors on the means to invest in validated ESG funds comprised of projects that generate federal and state tax credits.

Along with a brief dive into ESG investing, Monarch’s new streamlined and easy-to-navigate website supplies background on each of its tax credit programs and the many benefits, including affordable housing, historic rehabilitation and renewable energy. Investors can learn about Monarch’s unique approach to tax equity and ESG investing and how it tailors its ESG solutions to the needs of each type of investor, including corporations, banks, insurance companies, family offices and more.

Also included on the new website, taxpayers can browse through Monarch’s portfolio of featured projects to learn of the positive impacts they have on their communities. From the number of jobs created by a historic building brought back to life to the CO2 emissions removed from the environment through a solar farm generating clean power, investors can easily find the many benefits of the firm’s ESG investments. Not only can taxpayers access the positive impact metrics of Monarch’s individual projects, but they can also use the firm’s new ESG impact calculator to quantify the impact of any affordable housing, historic rehabilitation or renewable energy investment under consideration. With just one simple input of the investment dollar amount, one can quickly determine their own metrics, such as the number of affordable housing units developed or the number of homes powered by a solar installation’s megawatts of renewable energy.

“Since the start, Monarch has been pairing tax equity investing with ESG to help our investors achieve their sustainability goals while mitigating their state and federal tax liabilities,” said George Strobel, Co-Founder & Managing Director of Tax Credit Investments at Monarch Private Capital. “Our new website will help you determine which of our ESG funds is the right fit for you and how we can help you positively impact communities through your investment while achieving predictable returns.”

Monarch’s mission is to positively impact communities, and its tax-advantaged investments have always been aligned with ESG principles. The firm’s new website illustrates the many benefits its projects bring to their communities while also quantifying the impact of its investments in affordable housing, historic rehabilitation and renewable energy. With its new website, the firm makes it even easier to determine both what a taxpayer’s sustainability goals are and the best practices in achieving them. Monarch’s ESG funds enable companies to successfully carry out their ESG initiatives, giving their money a mission.

For more information on Monarch’s ESG funds and sustainability initiatives, please contact George Strobel by emailing gstrobel@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

Related Posts

Monarch Private Capital and Invenergy Close Nearly $170 Million Tax Equity Financing for Samson Solar Energy Center II

Sep 16, 2024

The 200-megawatt facility in Texas will be capable of powering more than 40,000 homes ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, […]

Monarch Private Capital Helps Drive Economic Growth in South Carolina Through Tax Credit Investments

Dec 2, 2024

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm, is proud to support South Carolina’s rapid economic growth. According to U.S. Census Bureau data, South […]

Affordable Housing Company Announcements Historic Rehabilitation

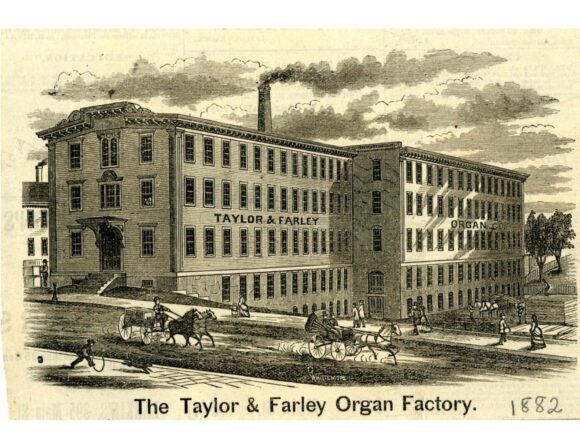

Monarch Private Capital Finances Historic Worcester Landmark

Nov 12, 2024

$13.5 Million Project to Transform Former Organ Factory into 36 Residential Units, Including Market-Rate and Affordable Housing ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment […]