Monarch Private Capital Commends Arizona for Passing New State Affordable Housing Legislation

Senate Bill 1124 will help narrow the affordable housing gap and positively impact Arizona communities

Monarch Private Capital, a nationally recognized tax-advantaged investment firm that develops, finances and manages a diversified portfolio of projects that generate both federal and state tax credits, celebrates the passage of Arizona’s new state affordable housing tax credit program. The Arizona Low Income Housing Tax Credit (LIHTC) resembles the federal program but offers a new layer of coverage to better support workforce housing, expanding the positive impact for more individuals and communities throughout the state.

Arizona Governor Doug Ducey signed SB 1124 into law, establishing a state tax credit that will be equal to at least 50 percent of the Federal LIHTC available to eligible developments. The new legislation provides $4 million a year for four years to be used to finance affordable housing projects. The Arizona state LIHTC is allocable, can be carried forward up to five years, and is applicable to properties placed in service between June 30, 2022, and December 31, 2025. This new program will be the largest investment Arizona has made in affordable housing, increasing access to quality affordable homes for hardworking families and individuals across the state.

“Monarch is excited to continue working toward reducing the shortage of quality affordable housing in the United States,” said Brent Barringer, Managing Director of LIHTC at Monarch Private Capital. “With a new state affordable housing tax credit program in place, we look forward to expanding the reach of our affordable housing investments to Arizona communities, helping forge a brighter, more prosperous future for the state and its residents.”

For more information on Monarch’s programs and services, please contact Brent Barringer by emailing bbarringer@monarchprivate.com

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

Related Posts

Monarch Private Capital Finances First State LIHTC in Indiana

Jul 18, 2024

$29 Million Multifamily Community Coming to Muncie as a Result of Recent Legislation ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]

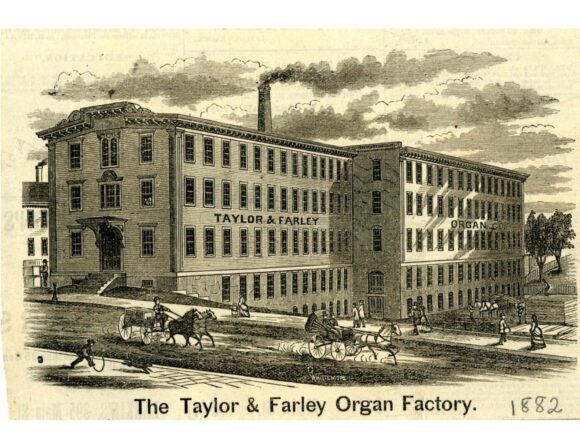

Novogradac Article: HTCs Help Compose New Song for Former Taylor and Farley Organ Factory in Worcester, Massachusetts

Jan 31, 2025

Nick Decicco, Senior Writer, Novogradac A former organ factor in Worcester, Massachusetts, with history reaching back to the mid-19th century is set for a future as 36 apartments thanks to […]

Monarch Private Capital Finances Historic Rehabilitation of New York and New Jersey Telephone Exchange Building

Oct 10, 2024

$59 Million Redevelopment Will Restore Brooklyn Landmark and Offer Luxury Housing by 2026 ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]