Monarch Private Capital Finances 300+ MW of Solar Energy Installations in August

The renewable energy facilities deliver clean power to regions in Mississippi, Tennessee and Texas

Monarch Private Capital, a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to announce the financial closing of tax equity investments in four solar energy projects totaling 305 MW in Mississippi, Tennessee and Texas. These projects, owned by Cubico Sustainable Investments, Elawan Energy, and Silicon Ranch, underscore a collective commitment to advancing sustainable energy solutions. The new renewable energy installations will generate clean power, support local economies and create jobs. The combined lifetime abatement of the investments is approximately 8.6 million MT CO2e, enough to power over 1.6 million homes for one year.

“In today’s rapidly evolving world, the significance of renewable energy cannot be overstated. As we face the challenges of climate change and a growing global population, sustainable energy sources like solar power play a pivotal role in securing a cleaner, more resilient future,” said Bryan Didier, Partner and Managing Director of Renewable Energy for Monarch Private Capital, “Our commitment to renewable energy, reflected in our financing of over 300 MW of solar energy projects in the past month alone, exemplifies Monarch’s dedication to fostering economic growth and job creation (particularly in areas of high unemployment and historic dependence on fossil fuels), all while contributing to a substantial reduction in carbon emissions.”

Monarch entered the renewable energy space in 2012, engaging tax equity financing to create a sustainable future as part of its mission to positively impact communities. The firm has supported renewable energy investments totaling more than $4 billion in development cost with more than 250 projects and portfolios across 29 states plus D.C., creating nearly 12,000 jobs. The 305 MW of new solar energy bring Monarch’s total clean power investment to 2.9 GW, abating more than 80 million MT CO2e over their expected 35-year or greater lifespans. This is equivalent to greenhouse gas emissions from over 17 million passenger cars driven for one year or CO2 emissions from charging more than ten trillion smartphones.

Since the Inflation Reduction Act (IRA) passed one year ago, U.S. solar and storage companies have announced over $100 billion in private sector investments, helping bolster the American economy, according to recent analysis released by the Solar Energy Industries Association (SEIA).

As part of Monarch Private Capital’s ongoing commitment to advancing sustainable energy solutions, the company is sponsoring RE+ 2023, the largest energy event in North America which takes place September 11-14 in Las Vegas. During the event the Monarch team will collaborate with leading developers, investors, and technology innovators on the common goal of strengthening America’s energy future, independence, and economy.

- Bryan Didier will share insights in two engaging sessions at the RE+ tradeshow. On September 11th, from 9:00 am to 10:00 am, Bryan will discuss ‘Financing Cleantech for Net Zero.’ On September 13th, from 1:00 pm to 2:00 pm, he will explore ‘Clean Energy’s Role in Corporate Sustainability.’

- Jonathan Gross, Director of Renewable Energy for Monarch, will participate in ‘The Great Debate – Tax Equity vs. Direct Pay’ session on September 12th, from 2:30 pm to 3:30 pm.

For more information on Monarch’s renewable energy projects, investments or to meet up at the RE+ tradeshow, please contact Bryan Didier by emailing bdidier@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

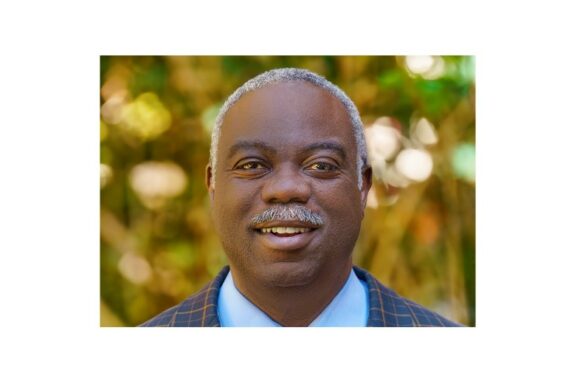

Monarch Private Capital Welcomes Walter L. McLeod as Managing Director

Feb 12, 2024

Monarch Private Capital, a nationally recognized impact investment firm specializing in the development, financing, and management of projects generating federal and state tax credits, proudly announces the appointment of Walter […]

IRS Alert: Beware of a New Clean Energy Tax Credit Scam – Consult Trusted Tax Professionals

Jul 10, 2024

The IRS warns against a new scam involving clean energy tax credits under the Inflation Reduction Act (IRA). Unscrupulous tax preparers are misleading taxpayers into improperly claiming these credits, especially […]

Kendall Sustainable Infrastructure with Monarch Private Capital, Advanced Solar Products, Independence Solar and Arcadia Begin Operation of New Jersey Community Solar Sites Serving Over 650 Households

Nov 27, 2023

Cambridge, MA – Kendall Sustainable Infrastructure (“KSI”) has begun operation of four new community solar projects totaling 4.4 MW and serving 686 households in and near Pennsauken and Moorestown, NJ. Partners […]