Monarch Private Capital Finances Historic Rehabilitation of Iconic Hotels

The Kimpton Cottonwood Hotel and Kinley Hotel offer revitalization and opportunity

Monarch Private Capital, a leading tax credit equity and ESG investment firm, is pleased to announce the closing of historic rehabilitation tax credit equity investment (HTC) in two iconic hotels in Omaha, Nebraska, and Cincinnati, Ohio. The rehabilitation of these properties will preserve the unique history of the buildings while also providing new resources and opportunities for the local communities and their residents.

The projects include the 75-million-dollar transformation of the historic Blackstone Hotel in Omaha’s Blackstone District and the 26-million-dollar rehabilitation of the Denton Building, also known as the old Jeweler’s Exchange Building, in downtown Cincinnati. Both built in 1915, the original architecture of each has been preserved to pay homage to the integral historic fabric of the two cities. In partnership with Clarity Development and GreenSlate Development, the Blackstone Hotel has been rehabilitated into the Kimpton Cottonwood Hotel. Now boasting 205 rooms, the full-service boutique hotel features two restaurants, a lounge, meeting space, an outdoor pool and more.

The original Blackstone Hotel featured multiple award-winning restaurants, rooftop gardens and a fleet of limousines in its prime. Considered the birthplace of the Reuben sandwich, the remarkably popular establishment successfully operated as a luxury hotel for nearly 60 years. The hotel hosted an array of high-profile visitors and was the location from which President Richard Nixon announced his campaign for the 1968 United States presidency.

Monarch collaborated with Vision Hospitality Group to transform the Denton Building into the Kinley Hotel as a part of the Marriot Tribute Portfolio. The Kinley Hotel offers 94 rooms and a restaurant and coffee bar on the first floor. The property is located immediately adjacent to Macy’s corporate headquarters and close to the Great American Ball Park, home of the Cincinnati Reds, and the Paul Brown Stadium, home of the Cincinnati Bengals.

The Denton Building, located in Cincinnati’s Race Street Historic District, was originally built to satisfy the growing need for professional office space in the area. From 1877 to 1951, the district served as a major retail spot of downtown, boasting a number of offices, shops and theaters.

“We are excited to be moving forward with these two properties despite the challenges the hospitality industry is currently facing in regard to the global health pandemic,” said Rick Chukas, Managing Director of Federal Historic Tax Credits for Monarch Private Capital. “We’re confident that the knowledge and expertise of our partners along with our equity capital can help foster a bright and prosperous future for the Kimpton Cottonwood and Kinley Hotels along with the local communities and economies in which they serve.”

Monarch Private Capital is actively pursuing new and exciting investment opportunities for its federal and state historic preservation funds. Please contact Rick Chukas by emailing rchukas@monarchprivate.com to discuss capital opportunities your federal or state historic tax credit projects.

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

About Clarity Development Group

By leveraging their unique expertise and nearly 30 years combined experience in residential real estate, Clarity Development relieves clients of the burdens of complex and often nuanced legal, engineering, construction and finance issues. They have designed, permitted, and built residential developments ranging from urban to suburban, historic rehabilitation to ground up new construction–using a combination of traditional financing and multiple layers of subsidies and incentives.

About GreenSlate Development

GreenSlate is responsible for developing and managing Omaha, Nebraska’s Blackstone District – a diverse, multi-use community where people can live, work and play. Located at the center of Midtown, the Blackstone District is designed with modern living in mind. Stretching from 42nd to 35th Streets, with only a short walk to a variety of businesses and entertainment.

About Vision Hospitality Group

A family-owned and -operated company, Vision Hospitality Group owns and manages premium select- and full-service hotels affiliated with the Hilton, Marriott and InterContinental brands. Founded in 1997 in Chattanooga, Tennessee, they promote a culture founded on core values–their Vision Values–so as to provide the finest experience for their guests and ongoing efforts of social responsibility to their properties’ communities. The result is a team that shares a common vision and abides by a culture that further inspires one another, setting the company apart in today’s competitive hospitality market.

Related Posts

Monarch Private Capital Helps Drive Economic Growth in South Carolina Through Tax Credit Investments

Dec 2, 2024

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm, is proud to support South Carolina’s rapid economic growth. According to U.S. Census Bureau data, South […]

Affordable Housing Company Announcements Historic Rehabilitation

Monarch Private Capital Closes on Tax Equity Financing for Affordable Housing and Historic Rehabilitation of 1904 Farnam in Omaha, Nebraska

Sep 26, 2024

$25 Million Project to Deliver Affordable Housing and Restore Historic Landmark in Downtown Omaha by 2025 ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm […]

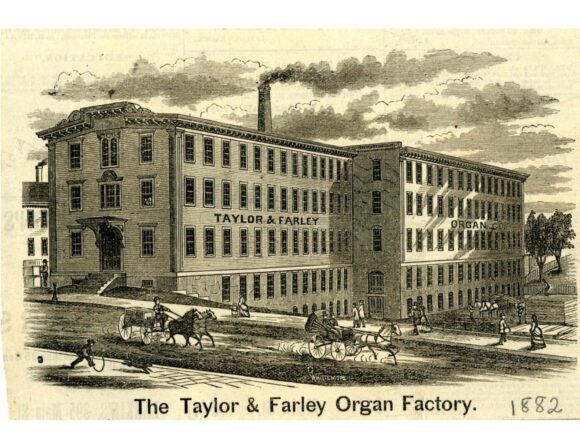

Monarch Private Capital Finances Historic Worcester Landmark

Nov 12, 2024

$13.5 Million Project to Transform Former Organ Factory into 36 Residential Units, Including Market-Rate and Affordable Housing ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment […]